By Fergal Smith

TORONTO (Reuters) -Canada’s government debt issuance is expected to surpass a pandemic-era record high this fiscal year, which could raise borrowing costs and add to calls for the ruling Liberal Party to be more transparent on its spending plans.

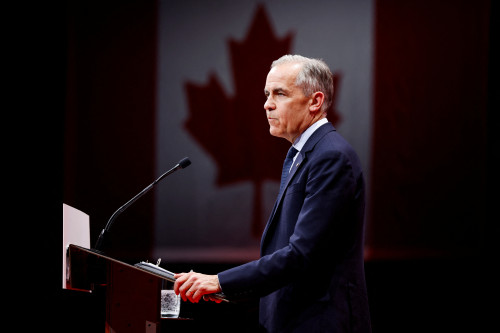

Prime Minister Mark Carney has said his government, which retained power in last month’s general election, will present a budget in the fall. The budget is typically tabled by April, the first month of the fiscal year.

With debt issuance running high, some analysts and investors worry the budget could reveal a surprise increase in government spending for the current fiscal year, resulting in increased bond issuance that needs to be absorbed by the market in a shorter space of time.

Canada sends about 75% of its exports to the United States so its fiscal outlook is particularly uncertain as the U.S. wages a global trade war.

Still, analysts can estimate Canada’s borrowing needs for 2025-26 by taking the government’s forecasted financial requirement in a December economic update, adjusting it for increased spending in the Liberal Party’s campaign platform and adding maturing debt.

The estimate comes to C$628 billion ($457.26 billion), according to Reuters calculations. That would exceed 2020-21 debt issuance of C$593 billion, and mean an even greater increase in the net supply of debt after much of the pandemic-era debt was purchased by the Bank of Canada to support the economy.

Bond maturities are historically high as some of the additional debt load accumulated during the pandemic comes due, while deficit spending remains elevated and the government began last year purchasing mortgage-related bonds to help lower the cost of housing.

Investors tend to demand higher returns for the risk of providing larger loans.

“We do think that this will have an impact on Government of Canada bond yields,” said Andrew Kelvin, head of Canadian and global rates strategy at TD Securities.

He forecast a steeper yield curve in Canada, where long-term borrowing costs rise faster than short-term rates, and debt issuance of C$645 billion this fiscal year. His supply estimate anticipates lower economic growth than used in the Liberal platform.

“Whatever is going to be in the budget, the more time the market has to process it, the easier it is for the market to digest that supply,” Kelvin said.

The Canadian 10-year yield has already climbed more than 50 basis points from its trough in April to 3.31%, tracking a move in U.S. yields as a worsening fiscal outlook for the United States raises concerns about demand for U.S. government debt.

The 10-year yield remains low by historic standards, but is trading 63 basis points above the 2-year rate, which is nearly the largest gap since November 2021.

While fiscal policy is a concern for long-term investors, the Bank of Canada’s interest rate-cutting campaign has helped anchor short-term rates.

Investors have said that Carney’s experience as a central banker is reassuring, but the long wait for a budget is unwelcome.

“It raises questions about transparency and contributes to greater economic and fiscal uncertainty,” said Joshua Grundleger, director, sovereigns at Fitch Ratings.

“It would be helpful for markets to have a clear sense of which aspects of the party platform will be implemented and what the ultimate impact will be on deficits, debt and the taxpayer,” Grundleger said.

Canada’s debt is popular with foreign investors but that demand cannot be taken for granted, analysts said. The Canadian dollar accounts for only a small share of foreign exchange reserves held by central banks.

“Markets need greater clarity sooner on debt issuance plans,” Derek Holt, head of capital markets economics at Scotiabank, said in a note. “If you’re going to do (the) fall, make it September.”

($1 = 1.3734 Canadian dollars)

(Reporting by Fergal Smith; Editing by Caroline Stauffer and Nia Williams)